HESLB LOAN ONLINE APPLICATION: Have you been asking yourself on How to apply for a loan through HESLB online application system? How to apply mkopo from HESLB? Well, in this article, we got all the details covered. Read this article to know how to apply for HESLB Loan in 2025.

In this article we are going to share all the details about this topic. Without taking more time in introduction part let’s dive directly to the lesson.

One moment please! Let’s first introduce what is HESLB and its roles in brief.

HESLB is an abbreviation for Higher Education Students Loans Board. In short, It is a board that provides financial supports to the university students taking degree programs and diploma as started early in this year. The board looks at different qualifications for giving a loan to the student.

What are the main criteria for being allocated with HESLB loan?

In order for you to get allocated with loan from bodi ya mikopo ya elimu ya juu, you first should meet the minimum requirements set for. There are several qualifications here are some of them: –

- Be admitted to the college/university.

- Economic status should be in state that needs support. Not having formal income/ employment.

- Should complete online application via HESLB website.

- Complete Advanced level studies, or other equivalent within 5 years.

- Not older than 35 Years.

- Tanzanian nationality.

- If there was a previous allocation, 25% of previous debt should be paid for another allocation.

Those are some of requirements needed for any students meeting them to be allocated for HESLB loan from HESLB.

Are there any official documents needed for HESLB loan application?

Yes! There are documents which are very important to include. Those documents show in detail and prove your identity. Among them they include: –

Documents for applicants -:

- NIDA Number

- Passport size image

- Bank account (Will be used for transferring Meals and Accommodation (MA) money from HESLB to you)

- Verification Number for Birth certificate (you have to verify your birth certificate if not yet). Same applied for the death certificates if applicable.

- Examination Numbers for Educational certificates

- Disability form (if applicable)

- TASAF form (if applicable)

- Sponsored form (if applicable)

Documents for applicant’s guarantors (Any of these) -:

- National Identification card.

- Voter’s registration card.

- Driving License.

- Tanzanian Passport.

How is the HESLB loan application process?

Here is where our main topic centred in this article! After having all the minimum requirements and the supporting documents, the important part is on how to navigate the application process. Here are the steps to complete the application

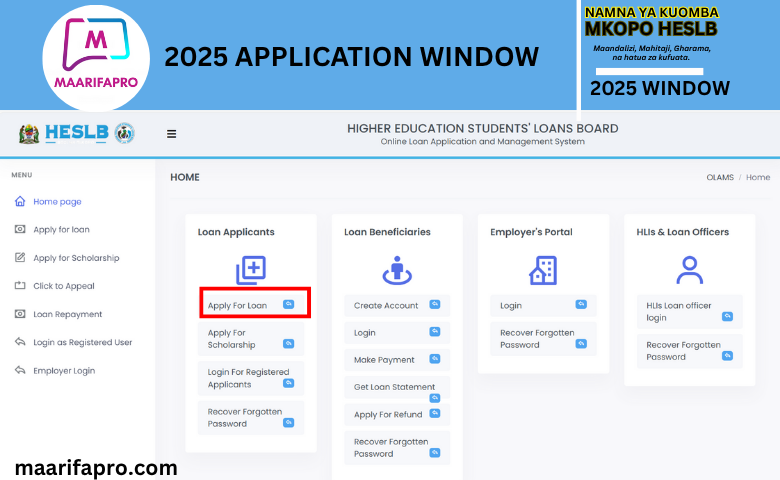

- Open the HESLB official website via the link at the last step.

- Select the Loan application option by tapping register your account as a new applicant

- Fill in your form four Index Number in the format S0000/0000/yyyy where yyyy stands for graduating year after choosing your category between S (School candidate) and P (Private candidates).

- Confirm your details and click next to fill your email and Phone number. Then click next to generate a control number in which you will pay Tsh 30,000/ for application form to open.

- After paying the application fee you will be able to proceed and the first part to move with, is to fill the personal details and the bank details.

- After completing the personal details section, the next step is to fill demographic section. This section includes the parents details also. So, fill it properly and attach all the required files like Voter or National IDs.

- Select your guarantor for your HESLB Loan trusteeship. The guarantor can be either of the parents or relative you are living with but should have the mentioned documents including the passport size image. After completing the details CLICK NEXT to move to the next part.

- Fill the academic details, sponsorship details and if you sat for exams more than one, you should include all the index numbers in this section.

- After filling all the sections, you should crosscheck the details and confirm all sections in order to be able to download the application form for signage. Print your form and sign all the required sections in Pages 2 and 5. The signage needed are from the applicant, guarantor, local government authority, and the Oath’s commissioners.

- After Signing the required sections, Scan the signed pages and upload to your online application HESLB account (SIPA). Confirm that all details are okay and submit your application.

- HERE IS THE OFFICIAL WEBSITE LINK

What happens if you apply for HESLB loan and you get rejected?

HESLB offers an appeal window latter after it has released all the allocated students lists. During this window, applicants who thinks that didn’t accepted HESLB decisions may Appeal for new allocation or additional HESLB Loan allocation. This method is functional to students with general minimum requirements or those with special cases.

Which are the special cases in appealing process?

There are several cases which are regarded as serious financial support needs. Among them are orphanage, disabilities of applicant or applicant’s parents, poor economic status, ended previous sponsorships, TASAF sponsored households, and others which may lead to serious financial support needs.

What will make these details to be legally accepted by HESLB?

Well, the answer to this question actually answers another question about HOW TO APPEAL FOR A HESLB LOAN ALLOCATION. The documents used should be original and obtained from the correct board dealing with such documents. These are among the documents that are highly recommended during appealing process.

(i) Death certificate to prove orphanage (RITA or ZCSRA).

(ii) Self-Disability Form (SDF-1) endorsed by the District Medical Officer (DMO) or Regional Medical Officer (RMO) or any designated medical

(iii) Parent Disability Form (PDF-2) endorsed by the District Medical Officer

(DMO) or Regional Medical Officer (RMO) or any designated medical

expert with recognized affiliations.

(iv) Corporate Sponsorship Form (SCSF-3) supporting financial assistance

received by applicant during pre-university/college schooling. SCSF-3 to

be endorsed by applicant’s corporate sponsor.

(v) Household vulnerability evidence endorsed by approved District Social

Welfare Officer.

(vi) Retirement letter endorsed by the last employer recognized by the

National Pension Scheme.

(vii) Social Support Beneficiary’s number from Tanzania Social Action Fund

(TASAF).